Trump vs China Part II: a self-defeating policy

| Date: | 18 September 2018 |

| Author: | Steven Brakman, Harry Garretsen, and Tristan Kohl |

Make America Great Again (MAGA) is key for Donald Trump’s agenda as president. An important part of his policies involves trade. With the mid-term elections approaching in November, Trump is stepping up his aggressive economic stance towards, in particular, China.

According to Trump, the deficit on the USA’s current account indicates unfair trade: other countries buy less from the USA than the other way around. Taxing imports is, in the president’s view, a way of forcing other countries into buying more from America.

The tariffs that the Trump administration has imposed this year are especially aimed at China, the country with which the USA has the largest trade deficit. Other countries were also hit by Trump’s tariffs. Tariffs were also imposed on imports from the EU and after the EU retaliated with tariffs against the USA. Negotiations to resolve this conflict are still ongoing.

The consensus among economists is that tariffs reduce welfare by preventing the international division of labor, that is, specialization. Specialization allows countries to start doing what they do best, and import the rest. So, imposing tariffs is silly from a welfare point of view, and tariff retaliation even sillier. America is using tariffs to make imports more difficult, but it could just as well have thrown rocks to block the harbor of New York. Other countries retaliate by throwing rocks in their own harbor, making it more difficult to import goods from the USA. Silly indeed. Trump, however, continues imposing

tariffs on other countries and on September 18, tariffs were imposed on $200 billion worth of imports from China.

What are the costs of this latest round of tariffs? We use the gravity model of international trade to calculate the consequences of the bilateral trade war between the USA and China. The notion behind this model is straightforward. On the one hand, countries trade more with each other the wealthier they are. On the other hand, countries trade less if trade is restricted by trade barriers such as tariffs, geographic distance and cultural differences.

Applying this idea to the latest round of tariff impositions, we calculated the effects of an increase in mutual tariffs between the USA and China of 25%, 50%, 75%, and 100%.

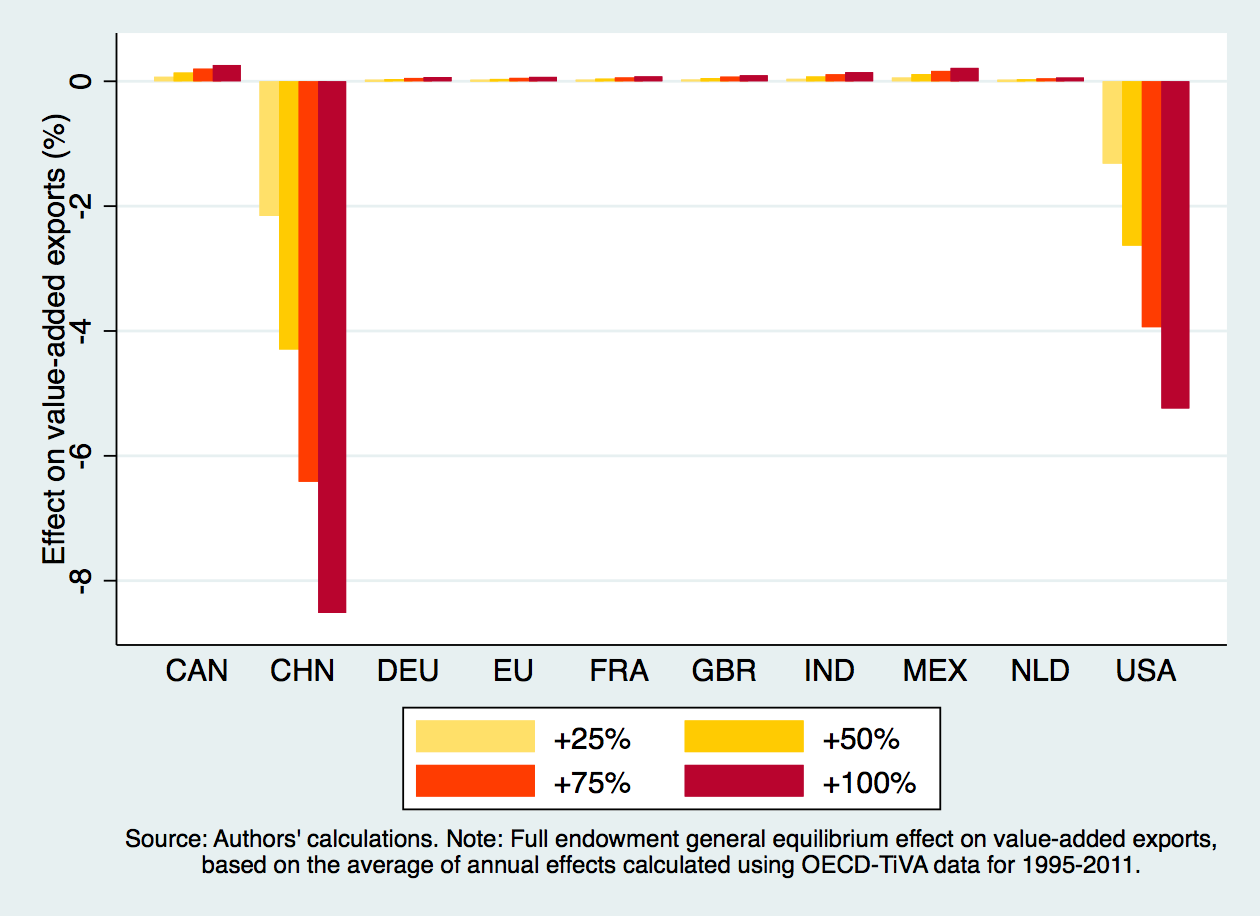

We find the following. Figure 1 illustrates the effects of this bilateral trade war on value-added exports.

Clearly, both the USA and China loose, regardless of by how much tariffs are increased. In case tariffs are doubled (i.e. a 100% increase in tariffs), Chinese value-added exports will drop by close to 10%. For the USA the decline is 5%. China loses more because the trade flows to the USA are larger than vice-versa. Other countries profit a bit because trade is shifted away from China and the USA to other sources, but these so-called trade diversion effects are very small.

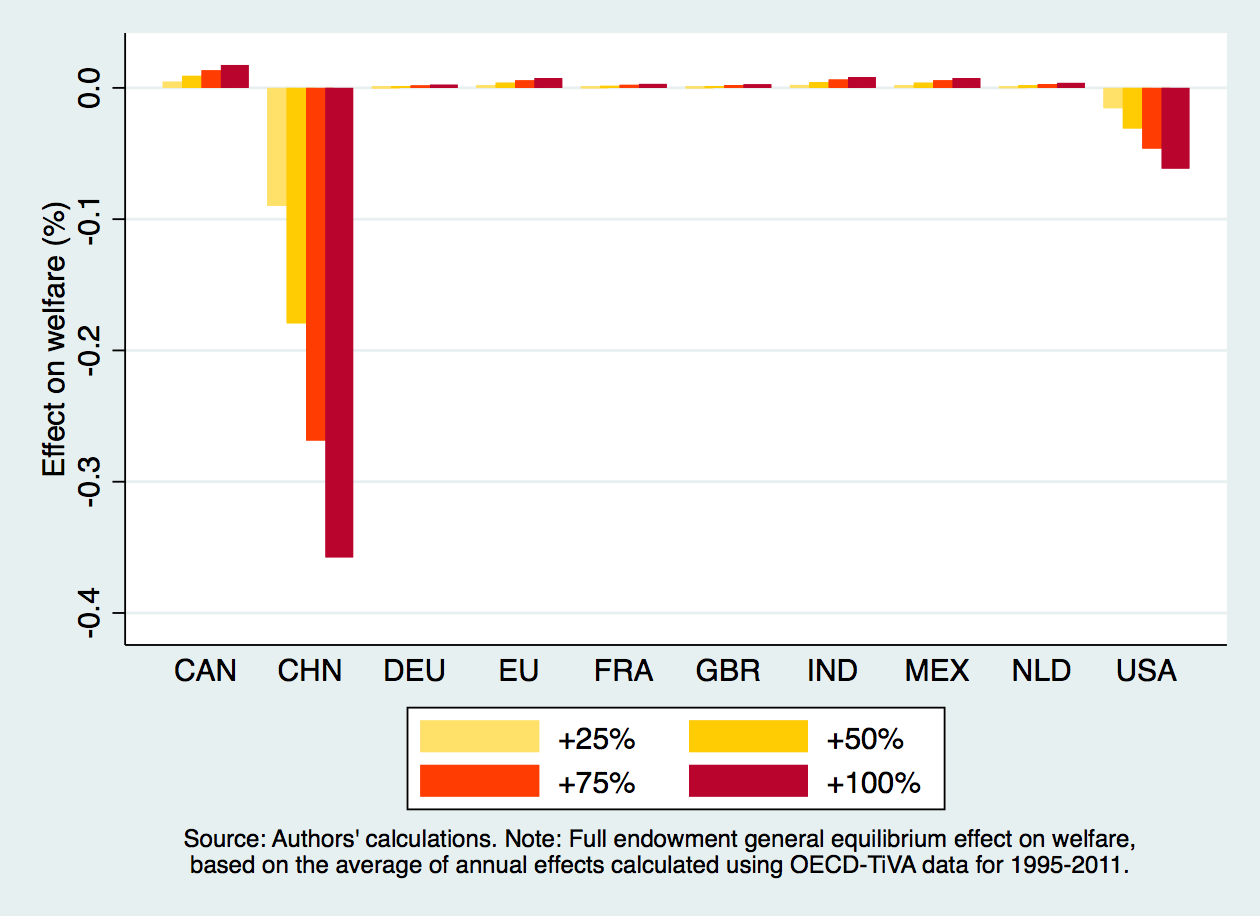

Similarly, Figure 2 shows the welfare consequences of the ongoing bilateral trade war, which are closely related to GDP. Chinese welfare will decrease by 0.35%, and America’s by close 0.1%.

How long will Trump continue throwing rocks in America’s harbors? A favorable electoral outcome for the Trump administration will most likely only further reinforce the current protectionist trade policies. A congressional majority for the Democrats might help restore trade relations somewhat, but these are unconventional times. Stay tuned until

after the mid-term elections…

Read more:

- Brakman, S. H. Garretsen, and T. Kohl (2018), Consequences of Brexit and options for a ‘Global Britain’, Papers in Regional Science, Vol. 97, pp. 55-72.