Phasing out Fossil Fuel Subsidies

| Date: | 18 October 2023 |

Extinction Rebellion has achieved what academics could not, says Bert Scholtens, Professor of Sustainable Banking and Finance. The environmental movement has put the massive and pervasive subsidies for fossil fuels on the political agenda. The rebels have a cause and are making it clear that fossil fuels are a curse, not a blessing. It is time to phase out fossil fuel subsidies for a healthier and more sustainable planet.

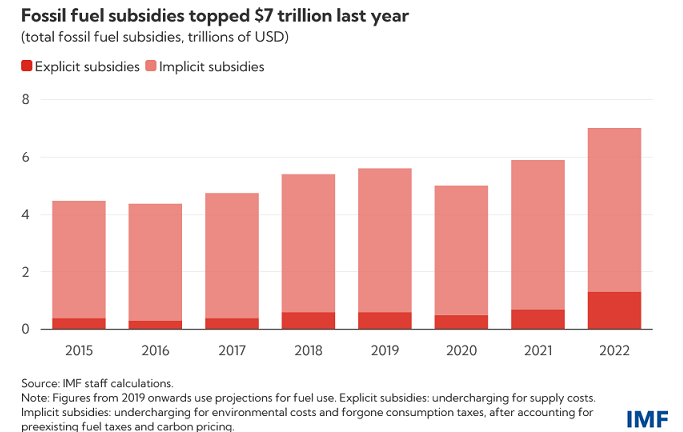

Cutting subsidies would go a long way to reducing air pollution, raising public revenue, and helping to mitigate climate change. This is because of their enormous size: Fossil fuel subsidies rose to a record $7 trillion in 2022: an increase of $2 trillion over the past two years [see the figure below; source: 1]. This growth is due to additional support from governments for consumers and businesses in the wake of the global energy price spike caused by Russia’s war on the Ukraine and the economic recovery from Covid-19. The use of fossil fuels comes at an enormous cost to humanity, particularly in terms of air pollution and climate change. Climate change is not a problem of the future, it is here and now. Hence the importance of rethinking support for carbon.

Emission Trading System

An often-used tool to reduce emissions from major polluters is putting a price on their emissions, as for example in the EU’s Emission Trading System (ETS) [2]. This would be great if the price fully reflected the externalities, but it does not. Furthermore, the ETS covers less than half of EU emissions. Globally, less than one-fifth of all emissions are covered in some way by such a scheme. So we should not sit back and wait for the ETS to do its job. Yes, we should use ETS, we should expand it, we should speed it up, but we must also cut the subsidies, as they increase the externalities.

Extinction Rebellion's protests are causing some confusion because not everyone understands what these subsidies are. Fossil fuel subsidies consist of a wide range of implicit and explicit subsidies. For example, undercharging for VAT (value-added taxes) is considered an implicit subsidy. Producer subsidies (for example, favorable tax treatment for fossil fuel extraction, such as accelerated depreciation) are counted as explicit subsidies. The majority of fossil fuel subsidies are implicit, as environmental costs (climate, health, landscape) are only partially (or not at all) included in fuel prices. However, critics of the IMF study [4] argue that the $5 trillion not paid by consumers (see figure below) may still be a gross underestimation.

Defining fossil fuel subsidies

Explicit subsidies relate to undercharging for the supply costs of fossil fuels. Implicit subsidies refer to undercharging for environmental costs and forgone consumption tax revenues [1]. Total fossil fuel subsidies are the difference between efficient prices (i.e. the sum of supply, environmental, and other costs) and retail prices multiplied by fossil fuel consumption. Given this definition, it is clear that confusion has arisen. This is because the subsidy is not a sum of money transferred from the public treasury to the account of the user or producer of fossil fuels. The subsidies are highly distortive because they create the wrong market incentives and exacerbate externalities.

For students of economics and business, it is helpful to acknowledge the definition of these subsidies. The explicit subsidy for a given fossil product, in a given sector, and in a given country is defined as:

[sectoral unit supply cost ─ fuel user price] × [sectoral fuel consumption]

While the total explicit and implicit subsidy is defined by:

[sectoral efficient fuel price ─ fuel user price] × [sectoral fuel consumption]

It is the explicit subsidies that are usually on the agenda of policymakers and academics. This is because they reflect fiscal costs. Direct costs for the government budget (e.g., rebates to households for energy purchases) or indirect costs in the form of losses/reduced profits for the subsidized firms. From an economic perspective, however, it is the total (explicit plus implicit) subsidy that matters if you want to get fossil fuel prices right. Enter the realization that climate change and health costs are just as real as supply costs.

Reducing global emissions and improving global health

If governments removed explicit subsidies and imposed corrective taxes, fuel prices would rise. This would encourage firms and households to factor environmental costs into their consumption and investment decisions. The result would be a significant reduction in global carbon dioxide emissions, improved air quality, fewer deaths from lung and heart disease, and more fiscal space for governments. Specifically, researchers at the International Monetary Fund [1] estimate that eliminating explicit and implicit fossil fuel subsidies would prevent 1.6 million premature deaths annually and increase government revenues by $4.4 trillion. It would also put emissions on track to meet global warming targets. Finally, it would redistribute income, since fuel subsidies benefit rich households much more than poor ones. The Netherlands also has massive subsidies and this seems to be recognized. I think we should thank Alman Metten for his perseverance on this issue and for bringing it to the attention of the Dutch public and politicians [4].

The removal of fuel subsidies should be done carefully. It is important that governments design, communicate and implement reforms clearly and carefully, and they should be part of a comprehensive policy package that emphasizes the benefits. For starters, a portion of the increased revenues should be used to compensate vulnerable households for higher energy prices.The rest must be used to reduce taxes on labour and investment and to finance public goods such as education, health care and clean energy.

To conclude, now is the time to phase out all fossil-fuel subsidies, for a healthier and more sustainable planet.

Author:

Bert Scholtens, Professor of Sustainable Banking and Finance

University of Groningen (Faculty of Economics and Business) & University of St Andrews

References:

[1] Black, S., Liu, A., Parry, I., and Vernon, N. (2023). IMF Fossil Fuel Subsidies Data: 2023 Update. Working paper, IMF, Washngton, DC. (this is a systematic analysis of fossil fuel subsidies and provides much detail as to the definition and assumptions used, allowing for international comparison; a bonus is that it is accompanied by country specific data)

[2] Mulder, M., Bollen, J., Cozijnsen, J., Lomme, S., Rooijers, F., Van Soest, J.P., Woerdman, E. (2023) Europees emissiesysteem bepaalt halen CO2-doelen, fossiele subsidies secundair. Economisch Statische Berichten, 9 oktober 2023 (in Dutch; this paper pleas against addressing the subsidies and advocates the case of trusting the Emission Trading System to address climate change)

[3] Rennert, K., Errickson, F., Prest, B.C. et al. (2022). Comprehensive evidence implies a higher social cost of CO2. Nature 610, 687–692. https://doi.org/10.1038/s41586-022-05224-9 (this is a critical reflection on the assumptions regarding environmental costs in the IMF reports)

[4] Metten, A. (2023). Belastingvoordelen voor fossiele brandstoffen nóg veel groter. MeJudice, 23 maart (in Dutch; this is an analysis of the development of fossil fuel subsidies in the Netherlands)