Who are your competitors?

| Datum: | 24 november 2020 |

While industries contain a large number of firms, each firm usually doesn’t view every other firm as a direct rival. It is easy to say which firms you view as your rivals, but do you know who they view as rivals? Are there firms out there that could influence your performance that are not on your radar yet? One way to avoid blind spots is to map the patterns of interdependence within your industry.

Firms following similar strategies tend to compete in upstream markets to get the best deals with their suppliers. They also compete in downstream markets to attract customers. As a result, these similar firms can influence each other’s performance—they are interdependent. This motivates them to interact with each other in an attempt to manage their interdependence. Typically, this involves a mixture of cooperative and competitive interactions. For example, rival auto manufacturers opened a plant as a joint venture to manufacture the Toyota Aygo, the Citroën C1, and the Peugeot 107. These competing models were actually identical except for the badge and some cosmetic differences.

In practice, it isn’t always clear where the boundaries of cooperation and competition are. Managers might be keenly aware of who their direct rivals are, but it is probably be less clear who their rivals view as rivals, and who those rivals view as rivals, and so on. To get a helicopter view of rivalry patterns in the whole industry, it can help to identify the groups of firms that are likely to be interdependent. The groupings show the competitive dynamics. For fans of Domino Day, a competitive action in one corner of an industry could triggers a cascading series of chain reactions that spread from region to region in the industry. Of course, if there is a wide enough gap separating some regions, then the isolated regions might be spared from the competitive chain reaction.

More formally, if the proximity of strategic positions reflects interdependence (the ability to affect each other’s performance), then distance (empty space) reflects its inverse—indifference. Thus, interdependent strategic groups can be seen as islands of interdependence separated by a sea of indifference. At the firm level, this helps managers focus their attention on the activities that are most likely to affect their firm. At the group level, the intensity of competition and the ability to sustain cooperative agreements can affect the performance of the group as a whole. These group effects on performance are in addition to those due to firm-level factors (e.g., resources, competences).

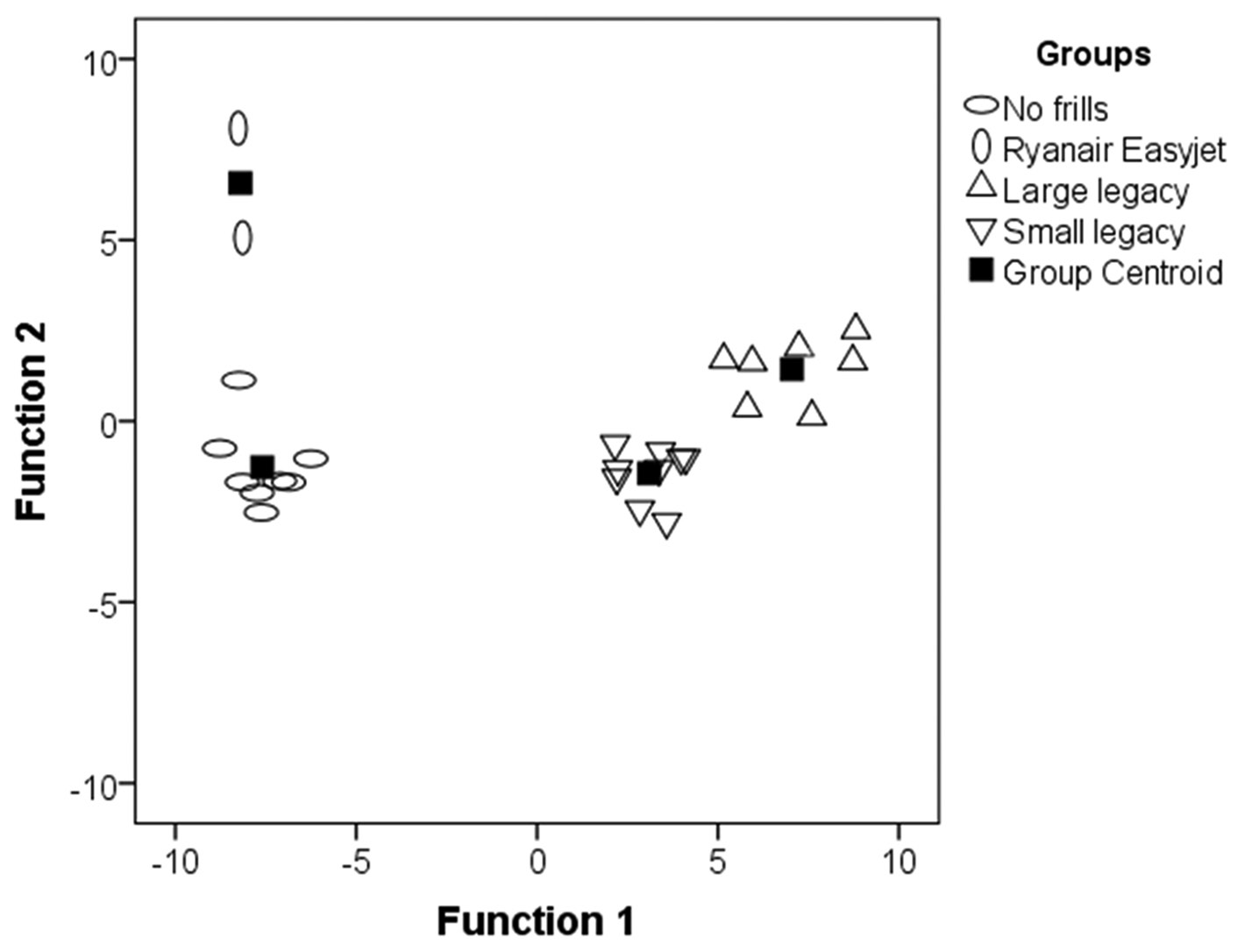

The figure below shows a map of the strategic positioning of firms in the EU airline industry. Even before the COVID crisis, most airlines were struggling to survive. Richard Branson famously said that it is easy to become a millionaire—start with a billion dollars and start an airline. So, it is a tough industry. Everyone knows the basic distinction between full-service (legacy) airlines and no-frills (low-cost) airlines. The map shows that each of these well-known groups can be divided in two. The analysis indicated that full-service airlines can be split based on size (large versus small legacy airlines). Both of these subgroups have a large number of firms holding very similar strategic positions. Further, the close proximity of the two groups means that competitive actions in one group could easily spill over into the other group. As a result, the interactions in both subgroups tend to lean towards perfect competition. This puts an enormous downward pressure on the performance of these airlines.

In contrast, the no-frills airlines are quite far from the full-service airlines in terms of strategic positioning. Consequently, competitive actions in full-service airlines are less likely to trigger a similar response from low-cost airlines, and vice versa. Still, there are enough no-frills airlines competing fiercely on price to severely depress performance. In this industry of struggling airlines, the notable exceptions have been Ryanair and EasyJet. The map reveals that this group is relatively isolated from the main group of low-cost airlines. Rather than trying to fly from anywhere to anywhere with routes in a hub-and-spoke design, they use a point-to-point design. This allows them to cherry-pick the most profitable routes and skip the rest. Perhaps more importantly, the point-to-point strategy also allows Ryanair and EasyJet to avoid overlapping routes. By side-stepping head-to-head competition within the group, they are able to function as a highly profitable duopoly.

If you think that mapping the patterns of rivalry might reveal some insights into the dynamics within your industry, please feel free to contact us to discuss setting up a study.

Charlie Carroll